This page contains references to diamonds or engagement rings from different companies. Sometimes I do receive a commission when you click on links and buy the products.

Over the past two decades, Blue Nile and James Allen have blazed the trail for online diamond buying. Blue Nile came on the scene in 1999 but between these two giants, the diamond industry has been revolutionized and for buyers, developing an understanding of how these companies rewrote the playbook on diamonds will offer invaluable insight into the perks of buying online.

Getting to grips with the business models may seem like a lot of homework just to buy an engagement ring, but I have no doubt that a little understanding will go a long way towards empowering you. Shop online with confidence, and find out which of these two leading vendors will come out on top.

Before Blue Nile…

The traditional model of the diamond supply chain starts with De Beers. At one time, the De Beers market share of rough diamonds was as high as 90% – although this had reduced spectacularly by 2000, the model remained the same. De Beers sell rough diamonds to a selected list of diamond polishers who have the rights to buy De Beers diamonds (sightholders). They are required to pay cash on each batch of rough diamonds which become available every six weeks. This equates to millions of dollars needed to acquire the diamonds which the polishers do not have.

This results in cash flow issues. The diamond dealers and jewelry stores purchasing the diamonds rarely pay in cash and rarely pay on time. A huge pressure is placed on the polishers to shift each load of diamonds before the new ones arrive six weeks later.

If you have read my articles before, you will know that I talk about over heads and stock in bricks and mortar stores. With so many quality, shape and size variants for diamonds, you need a huge physical inventory in order to really present customers which the choice they need. A store holding 100 diamonds (which would be no where near enough to make reasonable comparisons) could still be spending up to a million dollars on that stock. As most companies can’t afford to do this, the diamonds are on loan (although this is not possible in all cases). Among other issues, for buyers this translates to hard-sell tactics as the pressure is on to move the diamonds and a limited selection. When you add to this the additional steps such as being part of the Kimberly Process to avoid blood diamonds entering the supply, and the huge overheads of running a jewelry store, you can see that the model is complex and expensive.

If you have read my articles before, you will know that I talk about over heads and stock in bricks and mortar stores. With so many quality, shape and size variants for diamonds, you need a huge physical inventory in order to really present customers which the choice they need. A store holding 100 diamonds (which would be no where near enough to make reasonable comparisons) could still be spending up to a million dollars on that stock. As most companies can’t afford to do this, the diamonds are on loan (although this is not possible in all cases). Among other issues, for buyers this translates to hard-sell tactics as the pressure is on to move the diamonds and a limited selection. When you add to this the additional steps such as being part of the Kimberly Process to avoid blood diamonds entering the supply, and the huge overheads of running a jewelry store, you can see that the model is complex and expensive.

In the simplest terms, the old system relied upon ownership. At each stage of the supply chain, the diamonds are bought outright or heavily loaned and this results in huge mark ups – up to 100%.

The Blue Nile Business Model

Like most business revolutions, much of the Blue Nile effect hinged on ‘cutting out the middle man’ and also removing the need to own the diamonds before selling them to the consumer. Blue Nile lists hundred of thousands of diamonds belonging to a multitude of different companies. They keep the Blue Nile inventory up to date using a constant electronic feed. It costs the companies nothing to list their diamond on Blue Nile but opens the door for millions of potential buyers who visit the Blue Nile site. When a diamond is sold on Blue Nile, it is sent from the supplier directly to the customer along with a Blue Nile invoice. The mark-up is around 18% which is a huge saving VS the 100% mark ups we see in bricks and mortar stores through the old system. The huge online inventory creates a real time look at diamond prices, forcing the different companies to compete and thus the prices are driven down for the customer.

When looking to purchase a diamond online it’s important that you are provided with internationally recognised diamond certificates, HD Video, Diamond Light performance images, H&A Images, Ideal Scopes etc, learn more about what you need here.

The fact that Blue Nile revolutionized the system does not give them an edge over the competition, nor does it allow them to offer cheaper diamonds than rival vendors. James Allen successfully filled in the gaps left by Blue Nile by investing in cutting edge diamond imaging technology and the world’s first ‘virtual loupe’. Since the introduction of diamond imaging by James Allen, Blue Nile have been playing catch up and at present, their imaging doesn’t rival the James Allen technology.

Comparing Diamonds: James Allen vs. Blue Nile

James Allen:

- Natural Diamonds: James Allen excels with a vast selection of natural diamonds, each presented with 360° HD videos. This feature allows customers to thoroughly inspect the diamond’s cut, clarity, and inclusions, ensuring a transparent and informed purchase.

- Lab-Created Diamonds: James Allen also offers a growing inventory of lab-created diamonds. These diamonds come with the same 360° viewing technology, allowing customers to appreciate the quality and craftsmanship. Lab diamonds are significantly cheaper and continue to decrease in price, making them an attractive option without compromising on quality. James Allen ensures that lab-created diamonds are graded by reputable labs like IGI, maintaining high standards of quality and transparency.

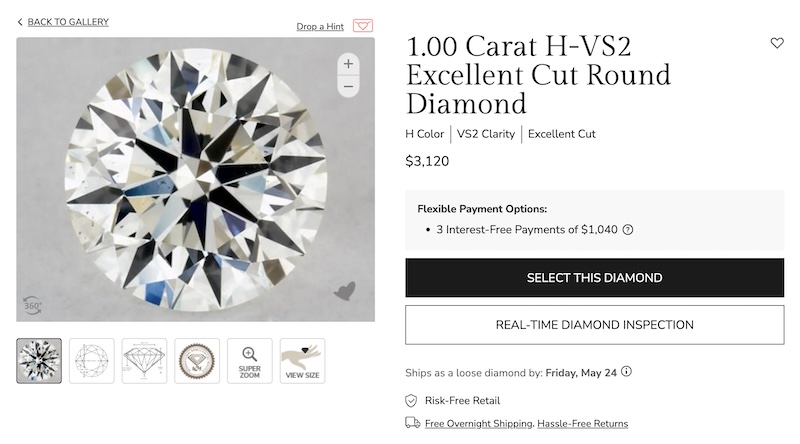

A 1.00 carat H-VS2 excellent cut round diamond displayed on James Allen’s website. The diamond is priced at $3,120 and features H color and VS2 clarity. The image showcases the diamond’s brilliance with a detailed close-up view. Flexible payment options are available, including three interest-free payments of $1,040. The page offers additional features such as a 360° view, super zoom, and size comparison. The diamond comes with free overnight shipping and hassle-free returns.

Blue Nile:

- Natural Diamonds: Blue Nile provides a substantial collection of natural diamonds, primarily certified by GIA. While they do not offer 360° HD videos, Blue Nile compensates with high-quality images and detailed grading reports. This approach gives customers a reliable understanding of the diamond’s quality.

- Lab-Created Diamonds: Blue Nile’s selection of lab-created diamonds is expanding, though it currently remains smaller than James Allen’s inventory. These diamonds are competitively priced, though slightly higher compared to James Allen. Blue Nile focuses on ensuring their lab-created diamonds are of high quality, with certifications from well-known labs. The lack of 360° videos is a drawback, but they are improving their imaging and presentation techniques.

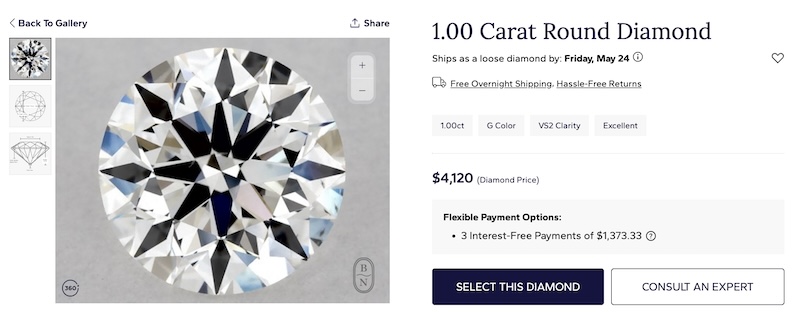

A 1.00 carat G-VS2 excellent cut round diamond priced at $4,120 on Blue Nile. The diamond offers exceptional brilliance and clarity, with flexible payment options and free overnight shipping available.

Key Points:

- Price: Lab-created diamonds are significantly cheaper at both retailers, with prices continuing to drop. This makes them a budget-friendly option for high-quality diamonds.

- Quality: Both retailers maintain high-quality standards for lab and natural diamonds, with certifications from reputable labs ensuring transparency and trust.

- Presentation: James Allen’s 360° HD videos provide a superior inspection experience, while Blue Nile offers detailed images and reports, gradually improving their presentation tools.

James Allen offers a more interactive and detailed shopping experience with their 360° HD videos, especially beneficial for scrutinizing both natural and lab-created diamonds. Blue Nile, while slightly behind in interactive tools, provides a reliable and competitive selection with detailed certification. Both are excellent choices, but your preference may depend on the importance of detailed visual inspection versus slightly lower prices.

Comparing Engagement Ring Settings: James Allen vs. Blue Nile

James Allen:

- Variety: James Allen offers a broad range of engagement ring settings, including solitaire, pavé, channel-set, side-stone, three-stone, tension, halo, and vintage styles. Each setting can be customized with various metals such as yellow gold, white gold, rose gold, and platinum.

- Customization: The “Ring Studio” allows customers to design their own ring by selecting the setting and the diamond. Real-time 360° HD videos enable buyers to see how different settings affect the diamond’s appearance, enhancing the customization experience.

- Special Collections: James Allen did have designer collections from brands like Verragio, Danhov, Martin Flyer, and Jeff Cooper but these pages have now been taken down. If you’re looking for designer engagement rings then Whiteflash is your best bet.

Blue Nile:

- Variety: Blue Nile provides a diverse selection of engagement ring settings, covering styles like solitaire, halo, vintage, side-stone, and tension. They offer options in white gold, yellow gold, rose gold, and platinum.

- Customization: Blue Nile’s “Build Your Own Ring®” feature allows customers to select a setting and a diamond, offering numerous combinations to fit personal preferences. Although it lacks the 360° HD video feature, it provides high-quality images and detailed descriptions.

- Special Collections: Includes exclusive designer settings from renowned designers like Zac Posen and Monique Lhuillier, adding a touch of unique craftsmanship to their offerings.

Key Points:

- Customization Tools: James Allen stands out with its interactive 360° HD videos, providing a more immersive and detailed customization experience.

- Design Range: Both retailers offer extensive and varied collections, but James Allen slightly edges out with more interactive customization and additional designer collections.

- Quality Assurance: Both ensure high-quality settings with options for different precious metals and styles to match individual tastes.

James Allen offers a more detailed and interactive shopping experience for those looking to customize their engagement rings, while Blue Nile provides a reliable and diverse range of settings with notable designer collaborations. Your choice may depend on whether you prioritize interactive tools and detailed customization (James Allen) or exclusive designer options (Blue Nile).

When comparing James Allen and Blue Nile, both offer excellent options for diamonds and engagement ring settings. James Allen stands out with its interactive 360° HD videos and extensive customization options, making it ideal for those who value detailed inspection and a personalized experience. Blue Nile provides competitive pricing, a diverse range of settings, and exclusive designer collaborations, appealing to customers seeking variety and value.

Richard Jenkins, The Diamond Guru

Get free assistance from the Diamond Guru today. You’ll be glad you did!

- Secure the best quality diamond for your budget.

- Don’t pay over the odds for your diamond ring.

- Have peace of mind that you didn’t get ripped off.

Have a Question? Contact us now…