Perhaps the most common questions throughout the jewelry buying process are those related to diamond price. It can feel as though, with so many factors to consider, finding a beautiful diamond for the right price is a lengthy and complex task. I will be taking you through the many variables when it comes to the price of a diamond and offering some clarity on matters of weight, quality and trade prices. There is no such thing as a cheap diamond (at least, not one that is worth looking at), however these steps will enable you to complete your own price research and avoid getting ripped off.

Calculating Diamond Price

In the diamond trade, the cost is calculated as follows:

Cost = Carat Weight x Diamond Price Per Carat

Using this, a trade price is calculated. For example, if the price per carat for a 0.75ct round brilliant is $4,600 you would calculate the cost like this:

0.75 x $4,600 = $3,450

This is the simplest element to calculating the cost of a diamond. The more complex element is understanding price per carat, which we will consider next.

Where Do I Find the Diamond Price Per Carat?

The most commonly used pricing sheets in the diamond industry are the Rapaport and IDEX. This information was once reserved for members of the diamond trade; however, they can now be purchased by anyone. If you’re curious about diamond buying and want the insider knowledge that these sheets contain, there is an option to receive the weekly price list for a one-off payment of $50. It is important to understand that these figures have very little bearing on the market value of a diamond and therefore are void when it comes to buying a diamond.

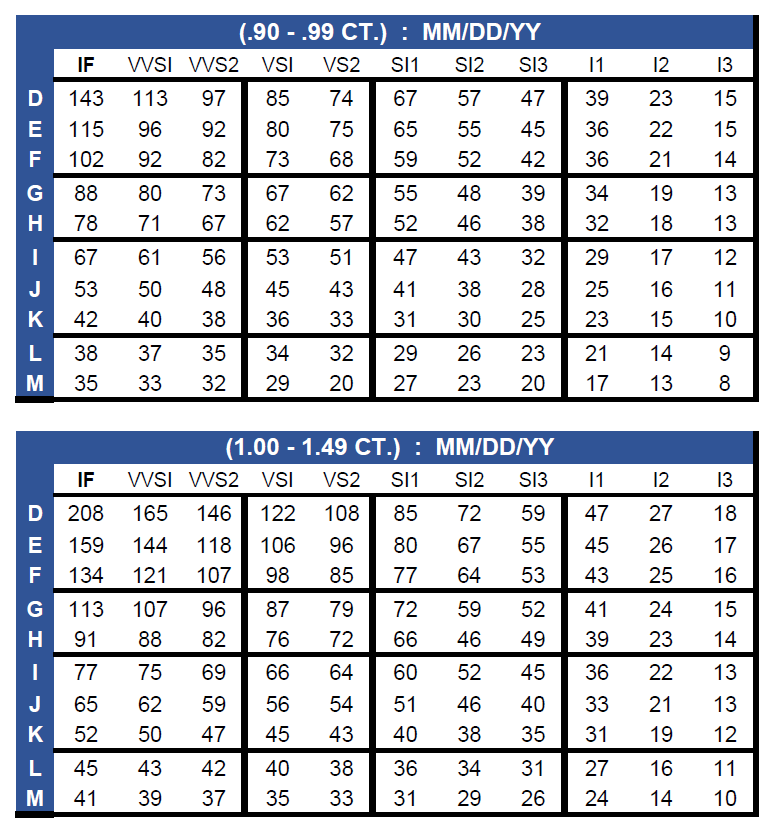

This is an example of how an industry pricing list will be presented. However, your research does not stop there. While finding out price per carat will offer little insight into how much you should pay; there are multiple other factors to consider in your diamond search.

This is an example of how an industry pricing list will be presented. However, your research does not stop there. While finding out price per carat will offer little insight into how much you should pay; there are multiple other factors to consider in your diamond search.

Beyond Rapaport and Rapnet

The Rap value has very little meaning to the consumer. Sadly, it is not the holy grail of diamond pricing, as the values listed represent the average high cash asking prices when the diamonds are traded. Depending on the characteristics of the diamond, it may be sold at a significantly higher or lower price than the Rap value may indicate.

The Rap report does not take into consideration the cut of the diamond, which grading lab has issued the certificate, fluorescence, grading accuracy and other factors which can dramatically alter the true value of the diamond.

The Rapaport can also be used as a sales tool to mislead unassuming buyers. Due to the variables, a salesperson may show a potential buyer the Rapaport to suggest they are buying a diamond at wholesale price or lower. The figures seen on the Rap list are the high cash values and cannot be used to make an accurate judgement on the value of a diamond. It is a deliberate deception to make the buyer believe they are getting a good deal. Ignore the Rap list unless you understand discounts, premiums and how the other factors influence the value.

The Correct Way to Research Diamond Prices – Diamond Calculation

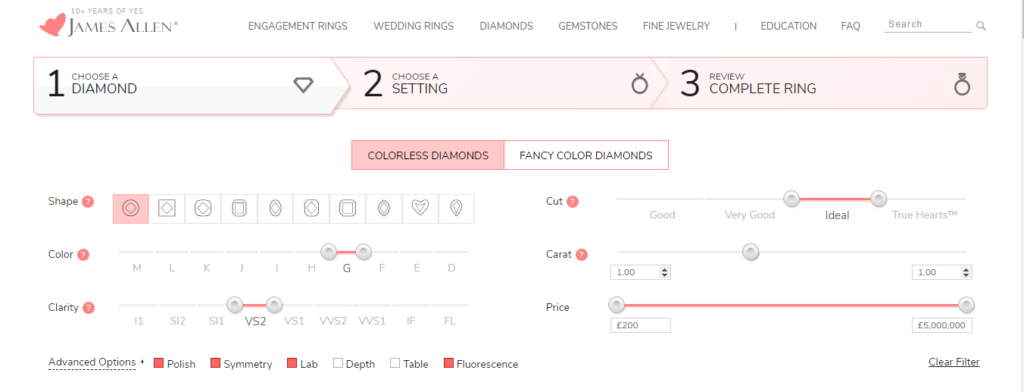

A simple and more accurate way of researching diamond price is by utilising the search tools provided by online diamond vendors such as Whiteflash, James Allen and Blue Nile. These highly functioning, consumer friendly tools allow you to search for a specific criterion (Color, Cut, Clarity, Grading Lab etc) and from this you can begin to establish a base cost. By selecting your parameters, you can instantly see all the available diamonds meeting your criteria and get a rough idea of the cost.

Image courtesy of James Allen

In this instance, I have used the James Allen search tools to look at GIA certified round brilliant diamonds of 1.00ct, G in color, VS2 quality with an excellent polish and symmetry and no fluorescence.

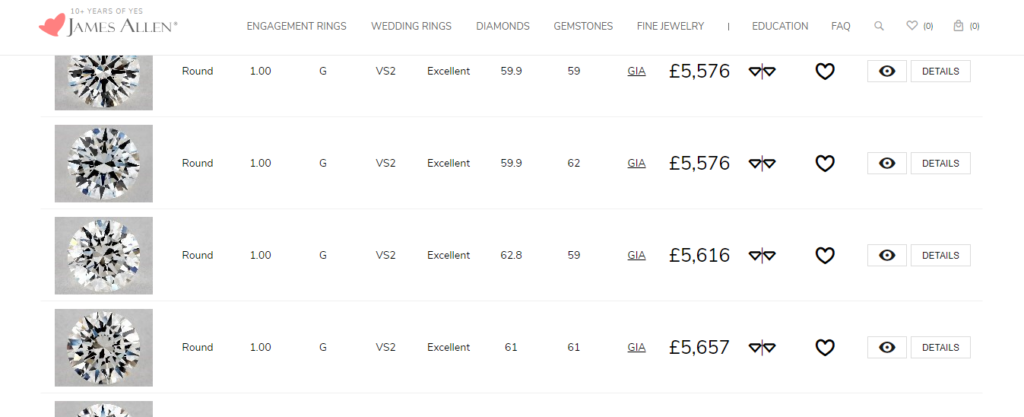

Image courtesy of James Allen

As you can see, the results turn up values with small discrepancies between them. So, you now have a base cost for a diamond with these characteristics. You know that if you see a diamond claiming to posses the same grade results for a much lower price, something is wrong. Equally, you can tell when a huge premium has been added.

To make fair comparisons to other vendors, you need to make the characteristics as identical as possible. No two diamonds are the same but using the four C’s is a great way to make the most accurate comparison.

Some important things to consider as seemingly small differences which can actually have a huge impact on price. A 1.00ct-G-VS2 certified by the GIA is not the same as a 1.00ct-G-VS2 certified by ELG.

Also, even the tiniest differences in carat weight can make a big difference. A 1.48ct compared with a 1.50ct can alter the price more than you might imagine. Keep your searches as even handed as possible.

I’ve Found my Base Price – What Next?

After establishing your base price, the more detailed elements of diamond buying come into play. First you must consider the visual properties of your diamond.

Two diamonds which are identical on paper can look entirely when viewed through a high-res image or by eye. Using the selection of James Allen diamonds that we looked at previously (GIA 1.00ct G-VS2) you can see that that diamond one has a small inclusion in the table whereas the inclusions in diamond two are effectively concealed by the cut.

The Rap report neglects differences in visual properties and also in price. Going by a Rapaport sheet would lead you to believe these diamonds should all be the same price, however our case study of this diamond criteria with James Allen turned up a difference of up to $700. So, why the difference?

Price Adjusting Factors -The Four C’s

Searching for diamonds with the same gradings is a good place to start, but as we have seen from our James Allen example, it can still lead to disparities in the price. The small table in the inclusion of diamond one is just one example of characteristics properties that can have an impact on price. Some examples are:

- Polish and symmetry grades

- The precision of a diamond cut: this goes beyond the symmetry grading given on the lab report. It refers to the optical symmetry of a diamond (hearts and arrows) which is a step above the symmetry gradings offered by the GIA and AGS gradings

- The presence of fluorescence can cause the diamond to go up or down in price. A medium to strong blue fluorescence can actually be desirable in diamonds with a G-J grading, whereas it lowers the price in D-F graded diamonds. Other colors of fluorescence such as yellow and green, or fluorescence that causes the diamond to have a milky appearance will all lower the value

- An eye clean diamond will have a higher market value than a diamond which has visible inclusions (even if the clarity grading is the same)

- The way the inclusions present themselves (i.e. do they cause a hazy appearance to the diamond which may affect sparkle, are they faint feathers which cause little effect etc)

- The thickness of the girdle can affect diamond spread and durability

- The hue or tint of the diamond is only factored in when the diamond has a color grading below K. However, diamonds with a grade above a K can still have undesirable colored hues which alter appearance and price

Other Price Adjusting Factors

- Designer mark ups can be huge. Think Tiffany & Co, Cartier, Van Cleef and Arpels…all the big names will have huge premiums. Even smaller chain jewellers will come in anywhere between 20%-100% more expensive than online vendors.

- Policies and warranties such as buy-back, upgrade, lifetime repairs, resizing etc can all be factored into the final cost of the diamond – I suggest reading my article on which company has the best trade up guarantee here.

- Factor in duty fees and taxes. These will differ depending on which country you are buying in.

The Final Word

One of the only ways to get honest advice and complete an accurate price comparison is by using online vendors and their search tools. Even the best salespeople will be guided by their company policies, targets and the limited information they have been given; with the best will in the world, you will not find the desired transparency here.

As I have said before, there is no such thing as a cheap diamond. Your goal should be a beautiful diamond for a good price. Research is key, as is using trusted sources to make the most accurate comparisons possible (remember, even the smallest differences in your criteria can turn up big differences in price. I recommend using Whiteflash, James Allen and Blue Nile to make your comparisons. Their websites are easy to use, and they have impressive inventories where you can make the best comparisons.

Remember when searching for a diamond that many retailers will have a premium range of diamond. Whiteflash’s A CUT ABOVE Diamonds for example are some of the best performing diamonds on the market. These super-ideal diamonds are some of the best in the world and perform to a standard that is beyond the AGS grading scale; it is worth factoring this in when conducting price searches as they will be more expensive, however they are the best quality on the market. In addition, the True Hearts Collection and Astor Collection from Blue Nile are their signature ranges so will also have a premium.